People whose field of study isn’t related to finance will always find terms related to this topic a bit strange. Economic profit is one of the most confusing terms in the financial sector.

Every transaction is the most valuable commodity for a business organization. Every company or firm is evaluated by profit, which is the unit of measurement.

To most people, profit is a hazy notion and is considered as a simple but not very applicable point; how can we regard it in terms of economics? This article will explain what is economic profit, the meaning of economic profits and losses, and teach you how to calculate them.

What is economic profit?

Inlay terms, economic profit is an approximation of profit minus the sum that is called ‘implicit cost’. Economic profit and approximate profit are two different meanings, and people often mix them up. The approximate profit is what I will explain first.

The difference between total revenue and direct costs is referred to as approximate profit. Physical expenses whose prices are written into a ledger book are explicit or direct costs. Physical expenses like taxes, leases, wages, and rent are included in these costs. The amount of physical profit that a company realized after carrying out a business is the total revenue. Money realized at the end of a transaction is known as this. In other terms, the approximate gain is the profit that people calculate after running a business operation. It is best to calculate both the physical and unseen profit. This will allow a company to gauge its stand in the long run.

After looking through the information mentioned above, I hope you acknowledge the meaning of approximate profit. Right now, I’m going to explain what economic profit is.

Economic profit is simply an approximation of profit minus the implicit cost. The last is the imaginary waste of resources that a company sustains when it chooses a business opportunity over another. Actually, it is the profits that a company missed because it chose one business opportunity instead of another. Adding these costs to the company’s ledger is not possible because they are not physical.

Business people use it to make the right choice for their business in the future. The total cost of all input for each transaction is the addition of unseen and seen costs. That includes the opportunity cost and direct cost.

Imagine If company C had two business options, say opportunity A and option B. if, after great pondering, the company’s authorities made their mind to apply opportunity A, the company’s approximate cost is the total revenue they get from opportunity A minus the cost they obtained while taking opportunity A. And their economic profit is their approximate profit minus the profit they would have made if they had picked option B.

People use it to calculate and measure their business plans. Without calculation of their opportunity cost and economic profit as a whole, a business doesn’t know when it is making the right business decision.

I’m going to explain how it is calculated, for you to understand it better.

How to calculate economic profit

To calculate economic profit, a company must first know its approximate cost and opportunity costs.

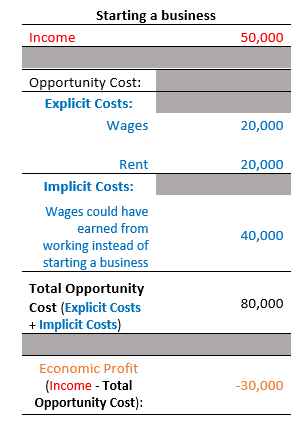

The overall formula looks like this: Economic Profit = (Total Revenue – explicit cost) – Implicit Costs (Opportunity Costs), while Approximate Profit = Total Revenue – Explicit Costs

To observe this operation in the real world, we take an example of some unknown entrepreneur, let it be Kevin. If Kevin had some work that brought him $10,000 in a year, and he wasn’t pleased with his job. He made a decision to quit and opened a private engineering firm. The man started the firm with $30,000 in savings, and after a year his business made up to $50,000. In order to calculate his economic profit, he must first calculate his approximate profit.

The approximate profit of Mr. Kevin’s private engineering firm equates to $50,000 (total revenue from his private engineering firm) – $30,000 (his explicit cost or in this case, his startup capital) = $20,000. As you can see, his net income is shown here.

And now, to measure his economic profit = $50,000 (total revenue from his private engineering firm) – $10,000 (his income per year if he was still working at his previous job) = $40,000.

The company made the right decision if the economic cost is higher than the opportunity cost. In the case of Kevin, he obtained an extra $40,000 for opting for a private business overworking as a usual employee.